This is part 2 of my response to the interview with Whole Foods CEO John Mackey in the collection The morality of capitalism; part 1 is here.

Earlier I discussed the introductory essay by the book's editor, Tom G. Palmer. Like Palmer, Mackey calls simplified history to his aid, and simply can't get the story he wants to tell to line up sufficiently with reality.

I saw what happened when Ronald Reagan got elected. America was in decline in the 1970s—there’s no doubt about it; look at where our inflation was, where interest rates were, where GDP was heading, the frequency of recessions, we were suffering from “stagflation” that revealed the deep flaws of Keynesian philosophy, and then we had a leader who came in and cut taxes and freed up a lot of industries through deregulation and America experienced a renaissance, a rebirth, and that pretty much carried us for the past twenty-five years or more. We had basically an upward spiral of growth and progress. Unfortunately, more recently we’ve gone backwards again, at least a couple of steps backwards. First, under . . . well, I could blame every one of these presidents and politicians, and Reagan wasn’t perfect by any means either, but most recently Bush really accelerated that retreat and now Obama’s taking it to extraordinary lengths far beyond what any other president has ever done before. (p. 24)There's a lot here to unpack. Mackey's story is that when Reagan took office in 1981, things were bad, and the policies Reagan implemented made things better, and the whole story shows that Keynesianism is deeply flawed.

Let's look at the numbers.

First, Mackey is right about the frequency of recessions: starting in late 1982, we had a long expansion under Reagan, a very long expansion under Clinton, and a reasonably long expansion under Bush II. Also, the recessions in between those expansions were short and "shallow": they didn't last very long, and GDP didn't fall by very much.

|

| Year-over-year percent change in real GDP. Shaded bars show recessions. Click for larger image. |

|

| Data from Bureau of Labor Statistics |

But that "upward spiral of growth and progress" is harder to find in the data. Leave "progress" aside, since we don't have a numerical measure of it. Focus on growth.

The actual GDP figures make it hard to spot growth trends, because of the fluctuations in the data - at the large scale there are the ups and downs of the business cycle, with expansions and recessions, but even from one quarter-year to the next quarter, there are perturbations in the growth rate.

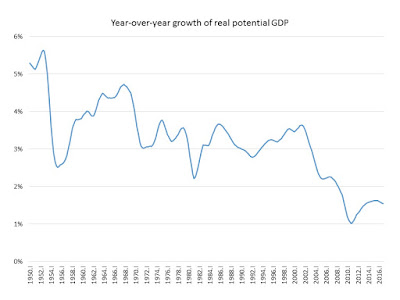

To see longer trends, look at the potential GDP, an estimate of the economy's long-run equilibrium path. The actual GDP tends to fluctuate around the potential, so if we're looking for long-run growth trends, we're not losing any information by using the growth of potential GDP as our indicator.

And we'll look at real potential GDP, which may sound confusing, since "real" sounds a lot like "actual," but in this setting "real" means "adjusted for inflation". And what do we find?

There's simply nothing there.

|

| Data from Congressional Budget Office, via Federal Reserve Economic Data |

Growth during Reagan's two terms - and for the 12 years after, during the administrations of George H.W. Bush and Bill Clinton - was about like growth during the 1970's, maybe a little lower. Long-run growth fell throughout the two terms of George W. Bush then recovered very slightly during Obama's terms. And growth during the 1960's was impressive compared to the 20 years of Reagan - 1st Bush - Clinton.

So, no great upward spiral of growth.

What about the stagflation? Yes, that was real. The late 1970's combined high unemployment and high inflation.

|

| U-3 measure of unemployment, and year-over-year percent change in CPI-U. Both data sets from Bureau of Labor Statistics |

But that's the most simple-minded Keynesian analysis. The very next step toward a more nuanced understanding of the economy is to think about not just changes in demand (when households, firms, and governments decide to spend more, or less), but changes in supply (conditions that make it harder or easier to make stuff or do stuff).

When there's a negative demand shock - a change that makes it harder to do stuff - the Keynesian model is quite clear about the consequences: less employment and higher inflation.

And the 1970's into the early 1980's provided a quite consequential supply shock: a period of oil prices higher than had been seen in almost 100 years.

By 1983 prices were falling. By 1986 they were only a little higher than the 20th-century average, and they stayed there through 2002 - the rest of that OK growth of the G.H.W. Bush and Clinton administrations. They climbed again in starting in 2002, and stayed astonishingly high through 2014.

This is hardly proof that the long-run growth of the economy is determined by oil prices. But Mackey is making an argument that is implicitly about data, and the history of oil prices does a much better job of matching up to the history of growth than does Mackey's preferred explanation of tax cuts and deregulation.

Why might Mackey have thought the Reagan administration kicked off an upward spiral of growth? I don't know where Mackey started economically - around 1980 he was the proprietor of a small health-food store, which doesn't sound like an exceptionally lucrative occupation. But during the 1980's that store grew into the Whole Foods chain, and continued expanding through the 1990's. In 2006, he voluntarily reduced his salary to $1 and donated his stock portfolio. But as the head of a growing company, he was presumably in the upper stratum of income in the U.S. And how has the income of people in that stratum changed?

|

| Data from World Wealth and Income Database, wid.org |

Meanwhile, how have most people been doing?

|

| Data from World Wealth and Income Database, wid.org |

The Reagan Revolution did nothing for this broad majority of the country, as average income continued to move sideways. The only significant upward movement was during the Clinton administration, followed by stagnation and collapse during the G.W. Bush administration, and minor recovery under Obama after the bottoming out of the Great Recession.

There must be a lot of variation within that bottom 90%, including some people doing better off while others actually see their incomes continually falling back. But there isn't room for any significant number of households to be having the kind of seven-fold income growth experienced by the top strata since the beginning of Reagan's presidency.

Mackey may be accurately reflecting the experience of himself and the people around him, while not being aware of the aggregate economic reality.

We haven't yet dealt with the "Keynesianism was deeply flawed" part of Mackey's story. Let's look at the Nixon-Carter-Reagan era to see what we can learn from that.

Here's the growth of real GDP, with a small recession at the end of the Carter administration, and a deeper, longer recession at the beginning of Reagan's first term, followed by a strong recovery that settles into modest growth:

|

| CPI-U from Bureau of Labor Statistics; Fed Funds rate from Federal Reserve; both downloaded from FRED (series CPIAUCSL and FEDFUNDS) |

Bear with me for a little technical stuff here. The Fed Funds rate is the basic policy tool of the Federal Reserve, the lever by which they attempt to shift the economy's behavior during non-extraordinary times (like after the melt-down of 2008). Lower interest rates should encourage borrowing, thereby encouraging spending, leading to an increase in overall economic activity.

The idea of the real interest rate is just the interest rate, adjusted for inflation. To find the real rate, you take the nominal rate (the interest rate you actually see on your bank account or on your mortgage) and subtract the inflation rate. (That's actually an approximation, which gets more and more approximate as inflation gets higher. But even at an inflation rate of 10% per year, it's usefully close for our purposes.)

The last question is what inflation rate to use in that calculation. An interest rate concerns something you have to pay going forward (if you're the borrower; if you're the lender, the interest rate is what you look forward to receiving going forward). And the inflation that matters to you is the inflation that will happen in the future. But of course neither the borrower nor the lender knows what that future inflation rate will be. To reflect that, I've converted the nominal Fed Funds rate to a real interest rate by subtracting the inflation for the 12 months preceding a given value of the interest rate.

OK, enough preliminaries. What you see on the chart is that the high inflation of the 1970's drove the real Fed Funds rate into negative territory - those are extremely favorable conditions for borrowers. In the late 1970's, as the Fed turns to fighting inflation under Paul Volcker, the real Fed Funds rate rises into moderately positive territory, then going to a very high level right at the end of the Carter administration and beginning of Reagan's first term. Inflation falls relatively quickly to under 5%, and stays low from there on. The Fed Funds rate makes its way down to more normal levels.

The next piece to look at is federal budget deficits. Here's the picture from 1949 through 2016:

|

| Budget data from Office of Management and Budget; potential GDP from Congressional Budget Office. Downloaded from FRED (series FYFSD and NGDPPOT) |

Look more closely at Nixon-Carter-Reagan-Clinton:

|

| Budget data from Office of Management and Budget; potential GDP from Congressional Budget Office. Downloaded from FRED (series FYFSD and NGDPPOT) |

That was followed by much larger deficits under Reagan: a huge one in 1983, three more very large ones, and a final two that were merely large.

Now we have the basic data we need. Time to tell a story.

- 1973 - supply shock (oil price spike): higher unemployment, with higher inflation

- later 1970's - continued high oil prices with low real interest rates and large federal budget deficits: declining unemployment and relatively high GDP growth, but increasing inflation

- 1979-80 - large supply shock (further oil price spike), plus real interest rates that are rising (though still low): high inflation and high unemployment

- 1981 - massive spike in real interest rates, combined with continued high oil prices: 10% unemployment, but falling inflation

- 1982 - big federal budget deficit

- 1983-1986 - unprecedented federal budget deficits for peacetime, with real interest rates remaining high but below their peak and oil prices continuing down, before collapsing in 1986: rapid recovery from a very deep recession, followed by reasonable but unspectacular growth

There's no need to invoke the tax-cut and deregulation fairies.

The end of the cited passage talks about a retreat from what Mackey sees as the virtues of the Reagan administration, accelerating under G.W. Bush, "and now Obama’s taking it to extraordinary lengths far beyond what any other president has ever done before." An interview doesn't always give you the room to clarify every detail of what you're saying, so it's understandable that Mackey doesn't explain what policies of Bush and Obama he's talking about.

Given his opposition to the Affordable Care Act, it could be that, plus Bush's advocacy for and signing of Medicare Part D (the prescription-medication coverage).

Could he be talking about the increase in the role of social spending? It's true that this indicator rose to new heights under Obama, but it hardly accelerated under G.W. Bush, merely returning to the level it was at during the first half of the Clinton administration.

|

| Source: BEA NIPA Table 3.2 Federal Government Current Receipts and Expenditures, divided by GDP |

Another measure of government size is the number of people working for the government, but that doesn't fit Mackey's story. Here's the federal payroll, divided by But it can't be the federal payroll as a share of all civilian employment, a share of the labor force (employed people, plus those looking for jobs), and the population aged 15-64.

| |

| BLS data downloaded from FRED, series CES9091000001, PAYEMS, CLF16OV, LVWA64TTUSM647S |

Overall government employment similarly fails to support a story about a relentlessly expanding government.

|

| BLS data downloaded from FRED, series USGOVT, PAYEMS, CLF16OV, LFWA64TTUSM647S |

For one last shot at trying to find some numbers that would support what Mackey's saying, we can look at the share of GDP collected in federal taxes.

|

| Source: BEA NIPA Table 3.2 Federal Government Current Receipts and Expenditures, divided by GDP |

The problem with Mackey's narrative isn't that it's an oversimplification.

Every narrative simplifies reality in order to tell a story. And every narrative is, in some settings, an oversimplification. A good narrative hews as closely as it can to the core reality as it makes its simplifications, so it ends up as a story that helps us grasp a complicated phenomenon while not fundamentally distorting it.

The problem with Mackey's narrative is that it's more false than true, which keeps it from being a good narrative.

It is, however, a useful one - if your goal is to reduce taxes on higher incomes and the social programs that they support.

No comments:

Post a Comment